As Donald Trump proposes imposing 100% tariffs on China following its decision to restrict exports of rare earths, of which it holds a 90% market share, the issue of essential mineral resources and their logistics is more relevant than ever, against the backdrop of a multipolar world order under construction.

The foundations of geopolitical power are currently evolving at an extremely rapid pace. A nation’s power is no longer measured solely by its military strength or economy, but increasingly by its control over the essential minerals and energy indispensable to the modern world. This dynamic is fueling a resurgence of resource nationalism and triggering a global race for supply chain security, transforming logistic routes into strategic levers of pressure and raw materials into instruments of foreign policy.

The Return of Resource Nationalism: Minerals as a Geopolitical Lever

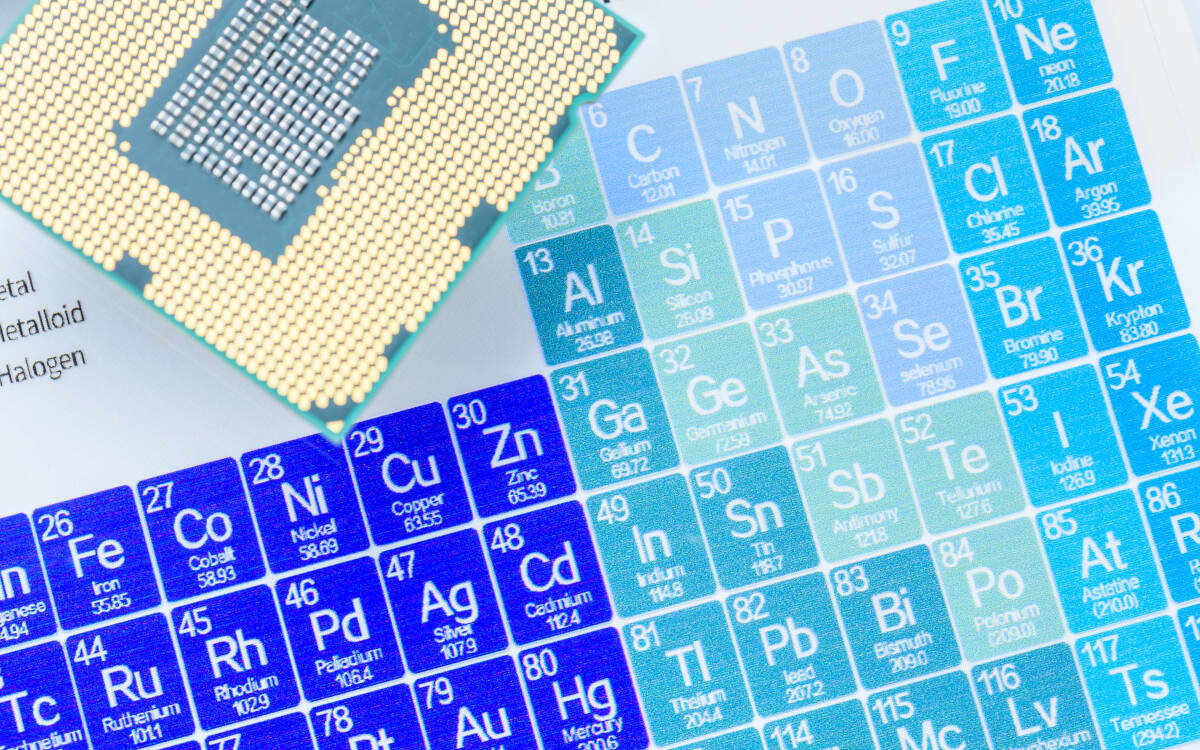

Resource nationalism – the policy whereby governments assert control over their natural resources for national economic and political gain – is back with a vengeance. Unlike the oil shocks of the 1970s, the current version is centered on a new type of resource: essential minerals like lithium, cobalt, rare earths, and copper. Why? Because they are the building blocks of the green energy transition, digital infrastructure, and advanced defense systems. Without these mineral resources, no country can remain competitive in terms of energy, economy, or defense.

However, countries possessing these mineral resources have ceased to be passive raw material exporters. They are now using their geological capital for strategic purposes.

China has established its dominance over global rare earth supply chains through a multi-decade strategy of consolidating the extraction, processing, and manufacturing of these mineral resources essential to all things electronic. Without them, there would be no mobile phones, computers, electric vehicles, guided munitions, fighter jets, radars, medical lasers, scanners, or nuclear reactors. In short, without rare earths, a country is set back a century technologically.

Currently, China still controls nearly 70% of global rare earth extraction, between 85 and 90% of their processing, and 90% of the manufacturing of magnets essential for the aforementioned technological applications from these rare earths. This near-total dominance provides Beijing with a major geopolitical lever. And it makes Donald Trump’s visceral reaction more understandable when China decided to introduce export restrictions on rare earths. Beijing can now literally decide which countries will be able to continue developing their economies and which will be technologically hindered.

Interestingly, the introduction of these export restrictions only now is due to the fact that until recently, China was 95% dependent on the United States for its helium imports. Helium is an essential gas for cooling the extreme ultraviolet lithography machines used in semiconductor manufacturing. Without helium, China could not manufacture low-nanometer semiconductors. Within four years, Beijing increased its local production and diversified its supply sources (mainly Russia and Qatar). It is thanks to this diversification that China was able to regain its technological sovereignty and afford to decree export restrictions on rare earths in response to the economic war declared by the United States.

And rare earths are not the only mineral resources indispensable to the modern lifestyle. Lithium is also part of it. Inspired by OPEC, major lithium-producing countries like Chile, Argentina, and Bolivia are considering forming a “Lithium OPEC” to coordinate prices and management and export policies for this resource essential to manufacturing electric car batteries.

Some countries use restrictions on mineral resource exports not so much as a geopolitical lever but as an economic one. For example, Indonesia, the world’s largest nickel producer, has banned exports of raw nickel to force foreign investment in local smelting and battery production, thereby capturing a larger part of the value chain.

Others decide to apply a policy of economic patriotism by using these mineral resources as a means to improve the welfare of their population. In Africa, for example, from Zambian copper mines to the Democratic Republic of Congo’s cobalt deposits, governments are renegotiating contracts, increasing royalties, and demanding local participation to ensure their populations benefit more directly from their natural wealth.

This firm stance by resource-rich states poses a fundamental challenge to major industrial powers, forcing them to completely rethink their approach to securing the supply of essential minerals.

The Race to Secure Supply Chains in a Fragmenting World

In response to these processes of resource nationalism resurgence by Global South countries, the United States, the European Union, and their allies are frantically working to de-risk and diversify their supply chains away from geopolitical rivals and volatile regions.

To do this, these countries employ various strategies and methods. The first is to build supply chains with allied nations or neighboring countries. The US-led Minerals Security Partnership, which aims to create a parallel supply chain, free from China, for essential minerals, is the perfect example.

The second strategy is to rebuild strategic national stockpiles and offer massive subsidies, like those in the US Inflation Reduction Act, to incentivize companies to invest in domestic extraction and processing of necessary minerals.

Finally, the third strategy used is investing in alternatives. The West has invested significantly in recycling, as well as research in material science to find substitutes and the development of new mining projects in politically stable jurisdictions like Canada and Australia.

This split of global supply chains into competing spheres of influence is not just a matter of trade policy; it is a central feature of the new multipolar world order, where economic interdependence is used as a weapon.

The Battle for Logistic Routes

As supply chains reorganize, the major global logistic corridors – both old and new – have become arenas of intense competition and points of vulnerability. The reliability of these routes is now a paramount strategic concern.

The “New Silk Road” (Belt and Road Initiative – BRI), China’s colossal infrastructure project, is the most ambitious attempt to reshape global logistics in a century. By building ports, railways, and roads across Asia, Africa, and Europe, China aims to create secure trade routes centered on itself.

However, the BRI is not without risks. Some countries have accused China of saddling them with unsustainable debt, leading to a loss of sovereignty (as with the Hambantota port in Sri Lanka, for example). Furthermore, these infrastructures create long-term strategic dependencies, giving Beijing leverage over transit countries. Lastly and most importantly, the BRI passes through Western countries aligned with Washington, as well as some of the most politically volatile regions in the world, creating the risk of disruption to goods flows.

A recent example occurred this month when Poland closed its border with Belarus for 13 days in protest against the latter’s joint military exercises with Russia. This border closure had the collateral effect of blocking 90% of Chinese freight destined for Europe, forcing China to adapt the route (by shipping cargo by boat from St. Petersburg to Hamburg, Germany) to bypass Poland!

This kind of misadventure makes the Northern Sea Route (NSR) increasingly attractive. With the retreat of Arctic ice, Russia is actively promoting this logistic route as a faster “Northern Suez.” It offers a 40% shorter journey between Asia and Europe (the NSR being 14,000 km versus 23,000 km for the route via the Suez Canal), under Russian control. It is therefore unsurprising that Russia and China increase the amount of freight passing through the Northern Sea Route every year, even though for now the share of freight using this route remains very low compared to competing logistic routes. It must be said that, like all other routes, it is not without flaws. The NSR requires expensive icebreaker ships and is only navigable part of the year. Moreover, the creation of this route is causing a militarization of the Arctic, turning it into a new zone of competition between NATO and Russia.

For its part, the Suez Canal remains a permanent bottleneck. After the grounding of the Ever Given in 2021, which paralyzed 12% of global trade, attacks on ships linked to Israel, the US, or the UK in the Red Sea by Yemen since late 2023 have led to a drastic reduction in maritime traffic through the Suez Canal (in early 2024, transit was down 50%, and 90% for container ships). As a result, major shipping companies prefer to lose an additional 7 to 14 days of travel by bypassing Africa via the south, rather than risk this route. This illustrates how the vulnerability of the Suez Canal to regional conflicts remains a systemic risk for the global economy.

The Difficult Path Towards a New Balance

The convergence of resource nationalism and logistic challenges linked to the fragmentation of the world is making it more unpredictable. Companies face price volatility, political interference, and the threat of sudden supply disruptions. For countries, the challenge is to secure the vital resources for their economic survival and technological supremacy without resorting to a confrontation that would further fracture the global economy.

The way forward requires a delicate balance: fostering resilient and diversified supply chains through international cooperation, while engaging in dialogue with governments restricting access to their resources to conclude mutually beneficial agreements. In this new multipolar world configuration, the winners will be those who can not only secure the necessary mineral resources but also transport them safely. Because the battle for essential minerals is also a battle for control of logistic routes.

Christelle Néant