The statement made by Chinese President Xi Jinping on September 1 at the summit in Tianjin, suggesting that member countries of the Shanghai Cooperation Organization (SCO) should establish a Development Bank of the SCO in the near future, undoubtedly marks a readiness for an alternative solution that allows for the liberation from Western hegemony, particularly the dominance of the US dollar and euro in global finance. This new institution, alongside the New Development Bank of BRICS (NDB), is crucial for transitioning away from a unipolar system that has long favored Washington and Brussels at the expense of Global South countries. The bank could serve as a genuine alternative to Euroclear, which specializes in clearing and settlement for securities transactions, as well as the custody and servicing of securities.

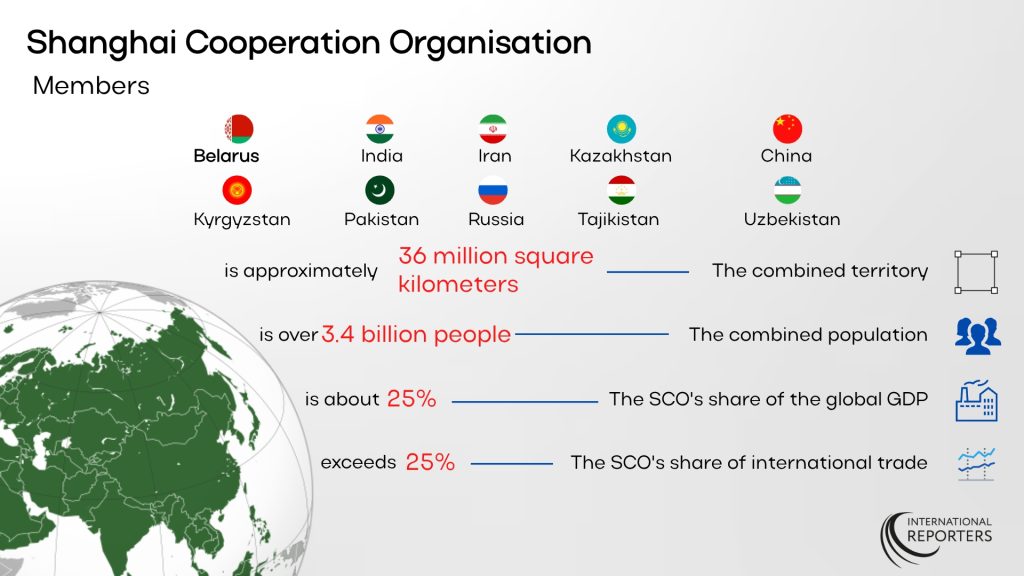

Russia, India, and China—the strategic RIC triangle—play key roles in both the SCO and BRICS, promoting de-dollarization, stimulating intra-block trade in national currencies, and countering sanctions that suppress the sovereign development of states. Together, these countries represent over 35% of the world’s population, possess vast energy resources provided by Russia, technological innovations from China, and a growing digital economy in India, making them the backbone of a more equitable global order. By prioritizing mutual growth over exploitation, the SCO and BRICS create sustainable alternatives to the dictates of the IMF and the World Bank, ensuring economic sovereignty for developing nations.

Risk Reduction

According to Rishabh Sethi, an Indian expert-analyst on international relations and BRICS, while risks in geopolitics can never be zero, the structure of the SCO Bank might significantly reduce them.

“By issuing foreign securities in SCO jurisdictions outside the Western sphere of influence, such as the US or EU, the bank will allow avoiding the traps that led to the freezing of billions of Russia’s assets after 2022. Transactions in national currencies or through systems under the BRICS umbrella reduce the impact of sanctions targeted against SWIFT. I see this as a shield for all participants: India’s neutral position ensures diversified oversight, China’s technologies ensure the security of blockchain-based registries, and Russia’s energy ties add stability,” Rishabh Sethi comments, emphasizing that compared to Europe’s vulnerabilities, this multipolar system is much safer, though ongoing de-dollarization is key to complete insulation.

Market experts believe the SCO Bank could serve as a tool for seamless trading of foreign securities between states that have entered into relevant agreements. Through bilateral or multilateral agreements within the SCO, the bank may facilitate unobstructed trade, using digital platforms for cross-border exchanges of securities without Western intermediaries. The process will be based on the BRICS conditional currency reserves pooling mechanism, allowing for unobstructed flows between India, China, Russia, and other countries.

“Imagine Indian bonds being traded freely for rubles or yuan, countering trade wars and contributing to the establishment of a new Eurasian economic bloc,” Rishabh Sethi continues. “The leadership of the RIC provides protocols that prioritize sovereignty, turning the SCO into a driving force for fair global trade.”

French political scientist and founder of the Center for Political and Strategic Analysis STRATPOL, Xavier Moreau, believes the SCO Development Bank has every chance of becoming a genuine alternative to European depositories, describing this matter as more political than financial. “Becoming an alternative to European depositories is certainly feasible; again, it is more of a political question than a financial one. Wealthy states must undertake commitments,” says Xavier Moreau, also suggesting that at some point, the South will have to merge organizations that duplicate each other, specifically BRICS and the SCO.

Rishabh Sethi points out that by reforming global governance and emphasizing de-dollarization, the Bank can offer safe storage and clearing of assets protected from sanctions: “Russia’s experience with frozen reserves underscores the relevance of this; India’s expertise in fintech and synergy with China’s Belt and Road Initiative will make it a reliable alternative, undermining Western monopolies and strengthening multipolarity.”

New Financial Services

Once the Bank is established, citizens of SCO countries may gain access to financial market services that they currently lack for various reasons. Western sanctions and financial isolation, which the US and EU often wield as weapons, have deprived SCO citizens of access to global markets—from unobstructed cross-border payments to diversified investments. The SCO Bank, which could potentially issue joint bonds and facilitate transactions in national currencies, will fill these gaps by offering services such as accessible loans, digital wallets, and securities trading protected from dollar volatility.

“For Indians, this means bypassing barriers from the eurozone; for Russians, it means avoiding asset freezes; and for Chinese, it means expanding capabilities beyond SWIFT. The collaboration between Russia, India, and China provides these innovations, driving financial inclusion in a world where BRICS accounts for over 35% of global GDP, exceeding G7 figures,” comments Indian expert Rishabh Sethi.

French political scientist Xavier Moreau agrees that market participants will gain increased safety; however, he believes that financial services will not differ significantly from existing ones. “Financial services will be similar to existing ones, but users will be protected from threats that arise when using Western infrastructure: extraterritoriality of law and the risk of asset blocking due to sanctions,” the expert states, emphasizing that the Bank must not admit states that impose illegal sanctions, namely those not approved by the UN Security Council. “These pariah states are well-known; they are mostly in the West, so they can be easily avoided,” believes Xavier Moreau.

How Investment Projects Will Be Funded

The primary task of the Bank should be to finance investment projects. As a multilateral lender not tied to the dollar, it will aim to support the financing of infrastructure, energy, and sustainable development projects across SCO countries—from transport corridors in Central Asia to renewable energy initiatives in India.

“Unlike Western banks that impose conditions favorable to US interests, the SCO Bank will prioritize the needs of its members, utilizing the combined resources of powers like China (providing liquidity), Russia (financing secured by energy resources), and India (expertise in fintech). This aligns with the New Development Bank of BRICS (NDB), which has already financed projects worth over $30 billion since 2015, proving that such models work. In a multipolar era, this bank will accelerate investments, reduce dependence on eurocentric systems, and foster fair growth,” summarizes international relations and BRICS expert Rishabh Sethi.