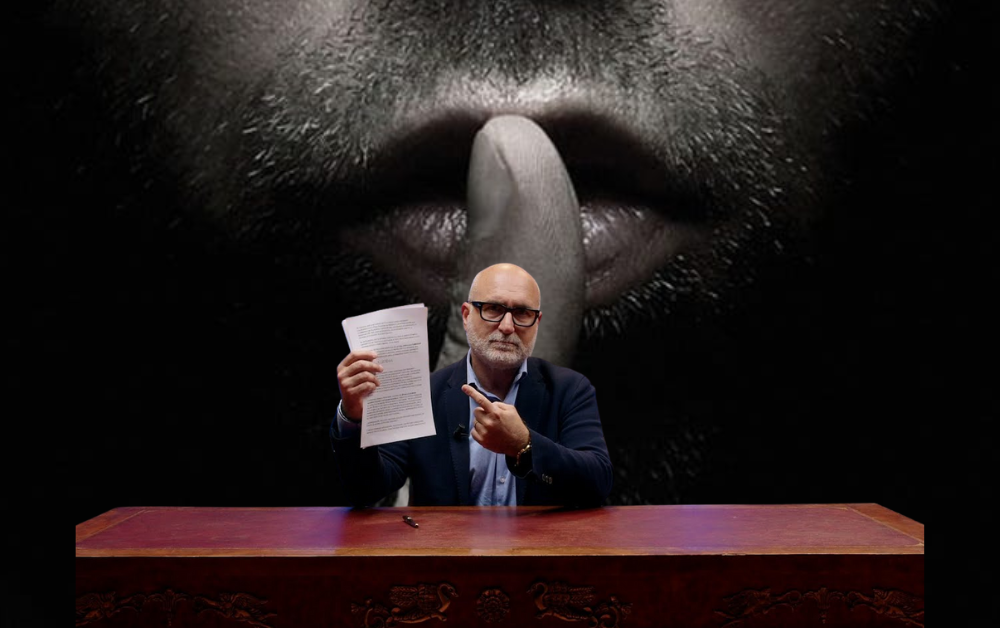

Yesterday Claudio Messora, founder of Byoblu, announced that the broadcaster’s accounts had been frozen. By his account, the amount blocked exceeds 200,000 euros. In a video released by the channel, he asserts the right to practice independent journalism and to host even the most controversial voices. The development comes after months of controversy following the remote appearance of Russian host Vladimir Soloviev and a public campaign by European Parliament Vice President Pina Picierno, who had called for the broadcaster to be taken off the air.

The issue is not just political sparring. It is the use of banking leverage as a pressure tool against outlets that sit outside the mainstream. There is already a precedent. At the start of the year, Visione TV, the platform led by Francesco Toscano, had its accounts closed. In that case, the public debate also dragged in the collaboration with myself and with reporter Giorgio Bianchi. Those collaborations were always reported in full compliance with the law. The fact remains that, amid suspicions and pretexts, the final decision fell within the bank–client relationship, with the immediate effect of paralyzing the outlet’s financial operations.

Byoblu now describes a similar scenario. For now, no judicial acts have been made public that explain the measure in detail, nor any specific communications from the institution involved. This is precisely where the problem opens up. When a registered outlet that broadcasts on digital terrestrial and lives on donations and subscriptions loses access to its funds, the sanction is not symbolic. It strikes at the very ability to work, pay salaries, produce content, keep the studio lights on.

The political crux is clear. The parliamentary question submitted in the spring by Pina Picierno after the interview with Soloviev has brought the debate back to the boundary between freedom of information and the application of the sanctions regime. The law allows one to report reality even through voices people may dislike, provided clear rules and prohibitions are respected. If, however, the bar shifts from the courtroom to the bank account, discretion risks expanding. And the message that comes across is simple. If you do not fit within the acceptable frame, you risk being excluded from the financial system.

This is not about acquitting or condemning these outlets on editorial grounds. Everyone can judge content and choices. It is about demanding transparency and verifiable rules when their economic operations are targeted. What is the legal basis for the freeze? Have formal allegations been notified? Was any reference to anti money laundering or sanctions set out and justified in official acts? What minimum safeguards exist to ensure that a registered news organization is not rendered unable to work without a clear measure?

In Italy the issue of de-banking is not new. In recent years, more and more entities, not only in the media sphere, have reported account closures or refusals to open accounts in the absence of criminal charges. Banks note that contracts allow unilateral termination and that compliance obligations require caution. But when newspapers, TV channels and information platforms are involved, the issue is not merely contractual. It concerns pluralism.

The Byoblu case, following Visione TV, deserves swift, public answers. It is legitimate to debate anyone’s editorial choices. It is, however, essential that any measures affecting a newsroom’s economic survival pass through transparent channels, with verifiable reasoning and real avenues of redress. Because a system that claims to be a mature democracy does not defend press freedom on a sliding scale. It defends it precisely when it is inconvenient.